Debit Supplies Expense 4950. Also charging supplies to expense.

Supplies On Hand Archives Double Entry Bookkeeping

For instance if the supplies expense has a 1000 debit the company must credit supplies for 1000.

. At the end of the accounting period a physical count of office supplies reveled 1600 still on hand. Credit Office Supplies 2400. At the end of the accounting period a physical count of office supplies revealed 900 still on hand.

Supplies on hand are shown on the balance sheet of the. Company ABC plan to pay the 2500 at a later date. So in this journal entry total assets on the balance sheet decrease while the total expenses on the income statement increase.

C Debit Office Supplies Expense 1400. The income statement account Supplies Expense. When a business purchases office supplies on account it needs to record these as supplies on hand.

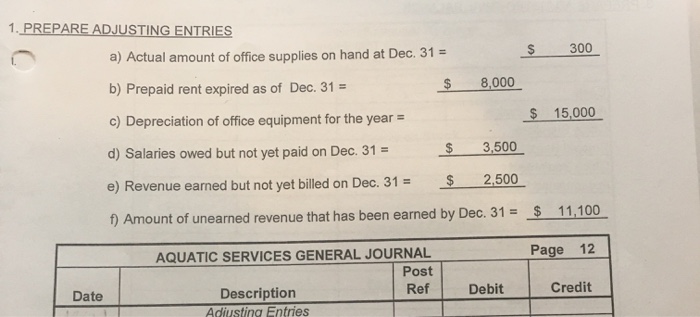

These entries involve at least two accounts one being a balance sheet account and the other being an income statement account. The appropriate adjusting journal entry to be made at the end of the period would be a Debit Office Supplies Expense 1600. This entry is made as follows.

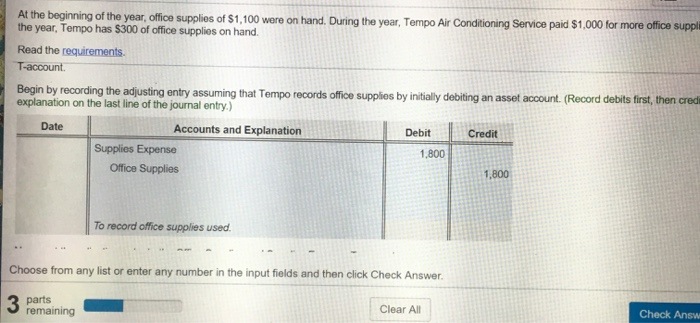

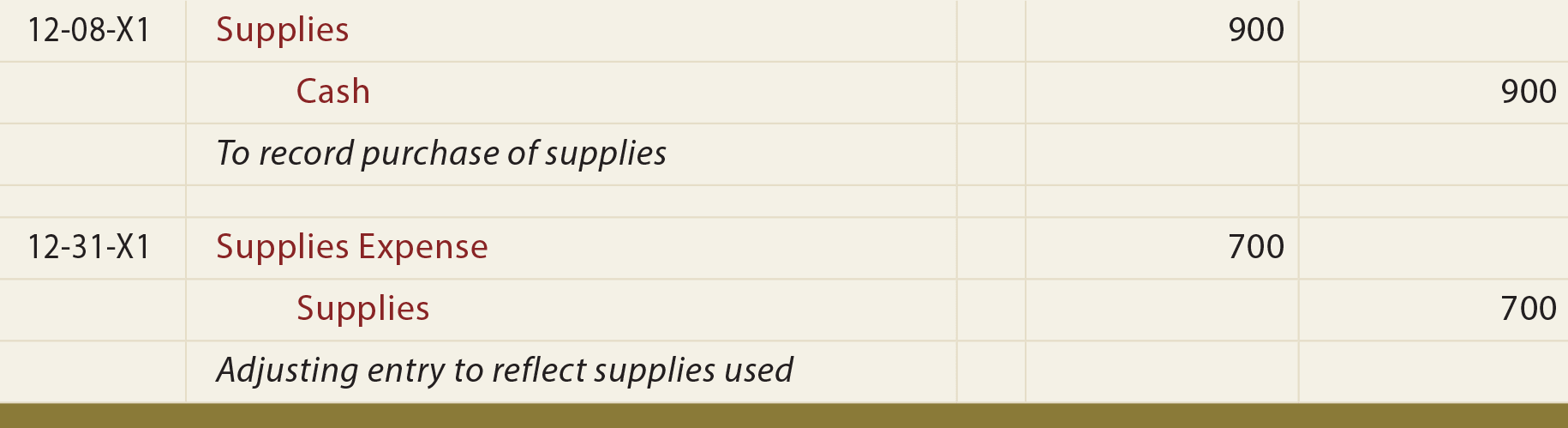

The Green Company purchased office supplies costing 500 on 1 January 2016. In this case the company has a 500 balance in its supplies account. Despite the temptation to record supplies as an asset it is generally much easier to record supplies as an expense as soon as they are purchased in order to avoid tracking the amount and cost of supplies on hand.

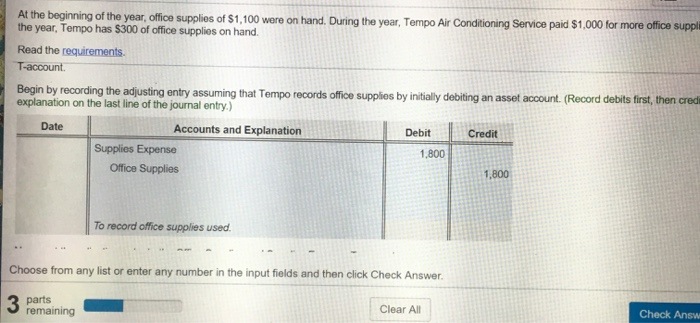

Quirk-Wit Company purchased office supplies costing 4000 and debited Office Supplies for the full amount. Write supplies on the line directly underneath the supplies expense entry. The adjusted journal entry is.

For example suppose a business purchases pens stationery. Supplies on hand at the end of the accounting period were 1800. Since it says we used 1750 worth of supplies this is the amount of the expense.

To provide accurate supplies on hand reporting make adjusting entries to adjust revenues and expenses. Credit Office Supplies Expense 1400. It is the expense of actual supplies that we used.

At the end of the accounting period a physical count of office supplies revealed 1600 still on hand. Shipping supplies are the cartons tape shrink wrap etc. At the end of the accounting period a physical count of office supplies revealed 2400 still on hand.

The asset also decreases by this amount. Debit Office Supplies Expense 2400. Debit Office Supplies 2400.

Credit Office Supplies 1600. Select the explanation on the last line of the journal e a. When an item is actually used in the business it becomes a supplies expense.

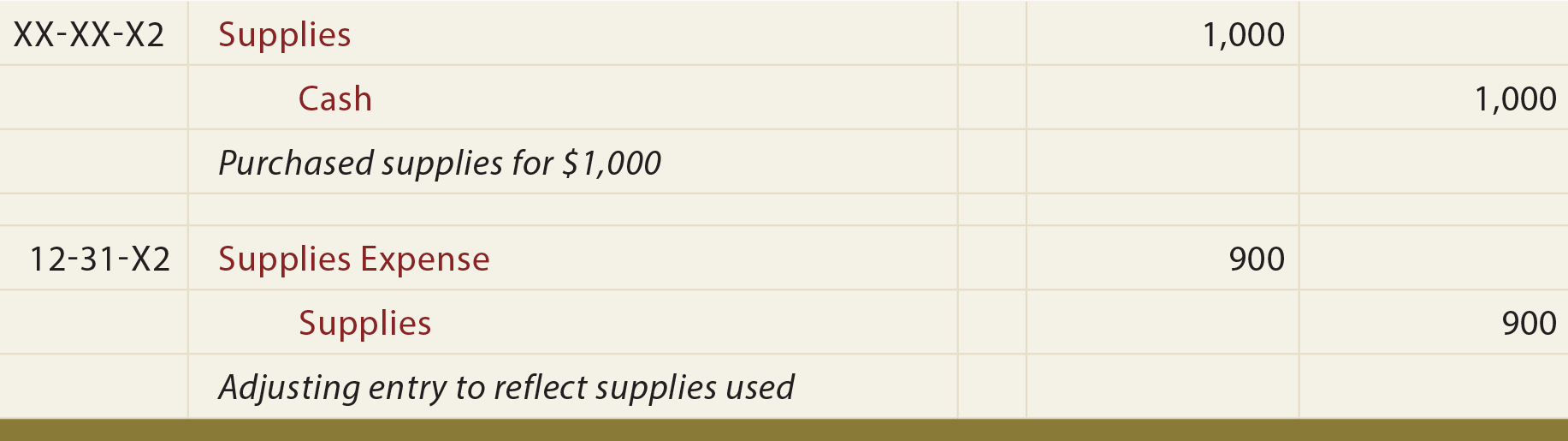

For example if you used 220 in supplies debit the supplies expense for 220 and credit supplies for an equal amount. At the end of the accounting period the cost of the supplies used during the period is computed and an adjusting entry is made to record the supplies expense. The appropriate adjusting journal entry.

Take your previous calculations and determine which account to debit and which to credit. Business Accounting QA Library c. The appropriate adjusting journal entry to be made at the end of the period would be a.

Manufacturing supplies are items. The supplies expense is an expense account. Office Supplies Expense Cr.

Therefore to sum up the options made above show that office supplies. Notice that the ending balance in the asset Supplies is now 725the correct amount of supplies that the company actually has on hand. As the supplies on hand are normally consumable within one year they are recorded as a current asset in the balance sheet of the business.

The appropriate adjusting journal entry to be made at the end of the period would be. Office supplies are likely to include paper printer cartridges pens etc. Office supplies are items used to carry out tasks in a companys departments outside of manufacturing or shipping.

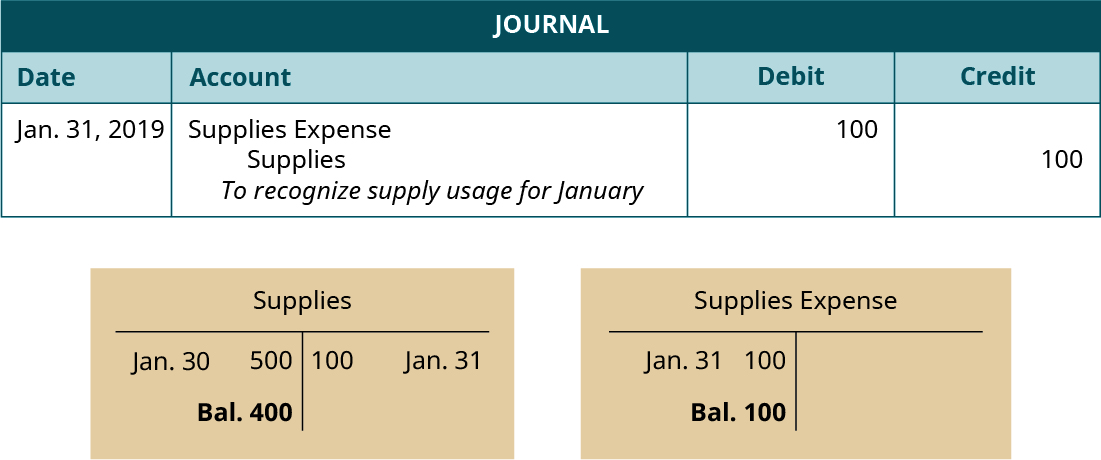

The adjusting entry after the services performed is. A Accounts Payable Accounts Receivable Accumulated Depreciation --Building Accumulated Depreciation -Canoes Building Canoe Rental Revenue Canoes Cash Depreciation Expense-Building Depreciation Expense-Canoes Interest. Balance the entry by crediting your supplies account.

Write the same amount in the credit column that appears in the debit column for supplies expense. When we credit it we are decreasing it. The office supplies account is an asset account in which its normal balance is on the debit side.

For preparing products that are being shipped to customers. Adjusting Entry at the End of Accounting Period. The appropriate adjusting journal entry to be made at the end of the period would be Debit Office Supplies Expense 1600.

Office Supplies Expense Prepaid Conclusion. The journal entry is given below. Make Adjusting Entries.

Ignatenko Company purchased office supplies costing 5400 and debited the supplies account for the full amount. Company ABC purchased Office supplies on account costing 2500. ACB company received cash of 1000 in advance of services performed and credits a liability account unearned revenue.

One may also ask is supplies on hand an asset. At the end of the year the following journal entries are created in case there are office supplies present on hand. At the end of the accounting period a physical count of office supplies revealed 2750 still on hand.

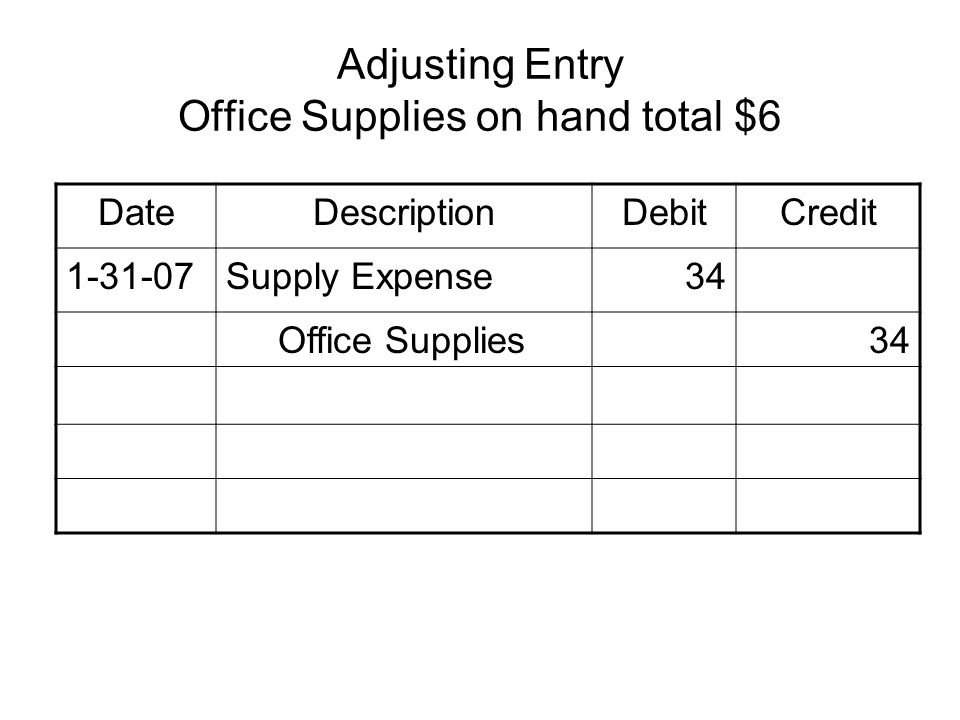

The beginning balance of Office Supplies was 2300. Purchase Office Supplies on Account Journal Entry Example. The adjusting entry for Supplies in general journal format is.

The supplies on hand is an asset account. Credit Office Supplies 1600. Debit Office Supplies 3600.

During the year Betterton purchased office supplies for 3000 and at December 31 the office supplies on hand totaled 1000. At the end of the accounting period a physical count of office supplies revealed 1600 still on hand. The following journal entries are created when dealing with Office Supplies.

Credit Office Supplies Expense 3600. Credit Office Supplies Expense 2400. B Debit Office Supplies 1400.

Thus consuming supplies converts the supplies asset into an expense. Debit Office Supplies Expense 2400. Likewise the credit of office supplies in this journal entry represents the office supplies used during the period.

Betterton prepaid a two full years insurance on July 1 of the current year 6000. Record insurance expense for the year. Office supplies on hand 165 Date Accounts and Explanation Debit Credit Dec 31 Adj.

Solved At The Beginning Of The Year Office Supplies Of Chegg Com

Record And Post The Common Types Of Adjusting Entries Principles Of Accounting Volume 1 Financial Accounting

Solved Prepare Adjusting Entries A Actual Amount Of Office Chegg Com

Journal And Adjusting Entries Ppt Download

The Adjusting Process And Related Entries Principlesofaccounting Com

The Adjusting Process And Related Entries Principlesofaccounting Com

Purchase Office Supplies On Account Double Entry Bookkeeping

0 comments

Post a Comment